Buying

Helping you find a home where you can make meaningful memories that you will remember forever. Moments that make life truly worth living.

We understand that buying a home is a life-changing decision. We believe in educating you with the knowledge you need to protect yourself throughout the process.

KNOW YOUR RIGHTS:

How to Protect Yourself in the Buying Process

Do you know how to protect yourself in the buying process? Our goal is to empower our clients with the knowledge and tools necessary to confidently step back from a contract, should the need arise. The seven contingencies include:

- Home Inspection

- Seller’s Disclosure Statement

- Condominium or Association Documents

- Survey & Staking

- Termite Inspection Report

- Preliminary Title Report

- Financing Contingencies

During the escrow phase, you, as the buyer, will be granted a specific timeframe to exercise your right to withdraw from the contract. Our commitment is to ensure that you are never pressured into a purchase that you are not comfortable with. We believe you should know your rights when entering into a legally binding contract.

Buyer's Class

Is buying a home a big deal? Do you want to know how to protect yourself in the home buying process? Would you like to learn buying best practices? Would a free home buying class with no obligation bring you value?

Ihara Team Home Buying Guide

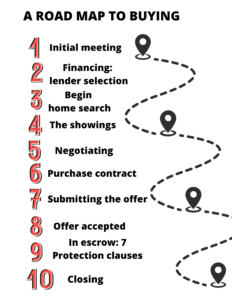

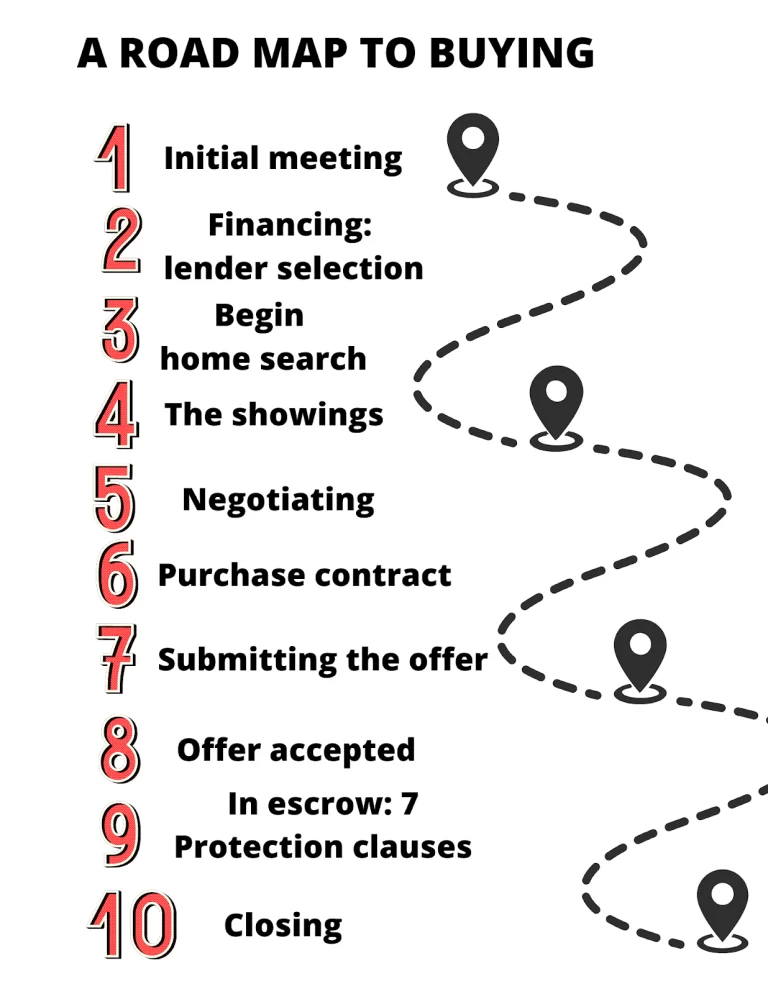

Initial meeting: Understand your needs, wants, and future goals.

Define:

- Location

- Size/floor plan

- Number of Beds/Baths

- Views/Topography

- Condition of property (Excellent – Tear down)

- Amount of time & Investments for improvements

- Mutual agreement to work together empowering us to advocate and protect you

Financing:

- Select a local, reputable, and experienced lender

- Determine financing options

- Determine what you can qualify for and what is comfortable

- Have a lender pre-approve you

Begin home search:

- Enter parameters into the MLS system & jointly identify properties to see

- Identify what is a want (good to have) or a need (absolute dealbreaker)

- Receive all properties within the specific parameters

- Coordinate showing schedule to efficiently find your home

Negotiation

- It starts with the initial showing and ends at closing.

- Ask proper questions that place you in a position of strength.

- Negotiate price and terms.

- Negotiate through each contingency.

How to make a winning offer

- Learn about the seller’s needs and motivation: What’s important to the seller? What motivates the seller? Who is the decision maker? Who influences the decision-maker?

- Study the market in depth

- Write the offer with attractive terms to the seller (if competing)

- Write a personalized cover letter to touch the emotions of the seller.

- We will recommend a strategy.

- Get the offer accepted successfully and close the escrow.

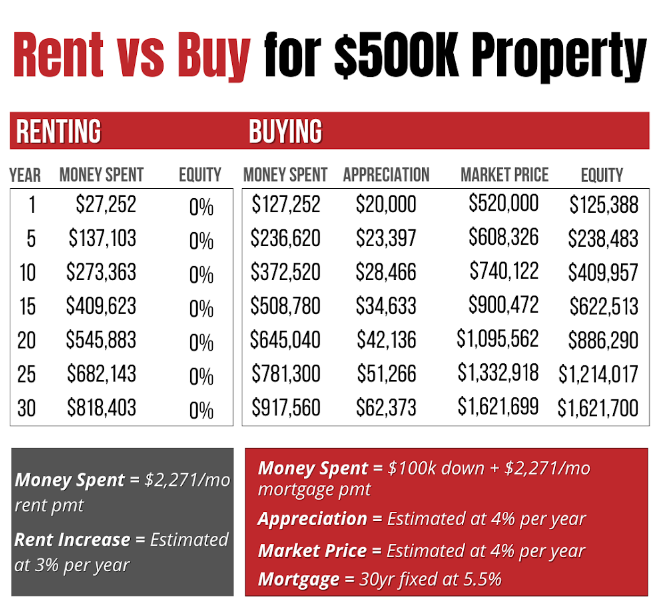

Should I rent or buy?

The person on the left is someone who is renting while the person on the right is someone who bought. They pay the same monthly payment except the person who bought put 100K down payment.

After 30 years the person renting has nothing but the person who bought has an asset now worth over 1.6 million dollars. This is the power of compounding and why 90% of all millionaires have done it on the back of real estate.

<form class="mcalc mcalc-conventional mcalc-color" name="cv" id="id_cv">

<div>

<div class="mcalc-main">

<div class="mcalc-half mcwp-purchase">

<label for="inp_purchase_price">Purchase Price</label>

<i>$</i>

<input type="text" name="purchase_price" id="inp_purchase_price" value="500,000" class="mcalc-dollar">

</div>

<div class="mcalc-half mcwp-term">

<label for="mortgage_term_yr">Mortgage Term</label>

<select name="mortgage_term" id="mortgage_term_yr">

<option value="30">30 Years</option>

<option value="25">25 Years</option>

<option value="20">20 Years</option>

<option value="15">15 Years</option>

<option value="10">10 Years</option>

<option value="5">5 Years</option>

</select>

</div>

<div class="mcalc-half mcwp-down-payment">

<label class="mcalc-half" for="down_payment_inp">Down Payment ($)</label>

<input type="text" name="down_payment" id="down_payment_inp" value="" class="mcalc-half">

<input id="ex1 e1" class="ex1 down_payment_scrl" data-slider-id="ex1Slider" type="text" data-slider-min="0" data-slider-max="80" data-slider-step="1" data-slider-value="5" data-slider-arialabel="DP Slider" />

<p class="mcalc-percent">5%</p>

</div>

<div class="mcalc-half mcwp-taxes">

<label class="mcalc-half" for="annual_tax_inp">Annual Taxes ($)</label>

<input type="text" name="annual_taxes" id="annual_tax_inp" value="" class="mcalc-half">

<input id="ex1 e2" class="ex1 annual_tax_scrl" data-slider-id="ex1Slider" type="text" data-slider-min="0" data-slider-max="20" data-slider-step="0.1" data-slider-value="1" title="Tax Slider" />

<p class="mcalc-percent">1%</p>

</div>

<div class="mcalc-full mcwp-interest-rate">

<label for="ex1">Interest Rate (%)</label>

<input id="ex1 e3" name="interest_rate" class="ex1 interest_rate_scrl" data-slider-id="ex1Slider" type="text" data-slider-min="1" data-slider-max="30" data-slider-step=".125" data-slider-value="7"/>

<p class="mcalc-percent">7%</p>

</div><div class="mcalc-half mcwp-insurance">

<label for="annual_insurance_inp">Annual Insurance</label>

<i>$</i>

<input type="text" name="annual_insurance" id="annual_insurance_inp" value="600" class="mcalc-dollar">

</div><div class="mcalc-half mcwp-hoa">

<label for="monthly_hoa_inp">Monthly HOA</label>

<i>$</i>

<input type="text" name="monthly_hoa_form" id="monthly_hoa_inp" value="500" class="mcalc-dollar">

</div><div class="mcalc-full mcwp-results">

<label for="cal1_email">Want a Copy of the Results?</label>

<input type="email" id="cal1_email" placeholder="Enter your email address" value="" name="email" />

<input type="button" id="wpmc1_send_mail" class="mcwp-submit bg cv_submit mcalc-color" value="Send Results!">

</div>

</div>

<div class="mcalc-values">

<div class="mcalc-results">

<h2 class="mcalc-value mcalc-payment">$<span id="emmp_div_span">1421</span>

</h2>

<h3>Monthly Payment</h3>

<p class="mcwp-pi">Principal & Interest <strong class="mcalc-value">$<span id="pi_div_span">1421</span></strong></p>

<p class="mcwp-mt">Monthly Taxes <strong class="mcalc-value">$<span id="mtax_div_span">1421</span></strong></p>

<p>Monthly HOA <strong class="mcalc-value">$<span id="hoa_div_span">1421</span></strong></p>

<p>Monthly Insurance <strong class="mcalc-value">$<span id="minsure_div_span">1421</span></strong></p>

<small></small>

</div>

</div>

</div>

<input type="hidden" name="principal_and_interest" class="pi_div_span" />

<input type="hidden" name="calculation_result" class="emmp_div_span" />

<input type="hidden" name="monthly_taxes" class="mtax_div_span" />

<input type="hidden" name="monthly_insurance" class="minsure_div_span" value=""/>

<input type="hidden" name="monthly_mortgage_insurance" class="mmi_div_span" />

<input type="hidden" name="monthly_hoa" class="hoa_div_span" value=""/>

<input type="hidden" name="type" value="cv"/>

<input type="hidden" name="action" value="mcwp_sendmail"/>

</form>

FAQ

Aren't all realtors the same?

All realtors are different. Just like all lawyers or surgeons are different. Realtors will differ on their level of experience, strategic approach, competence of the contract, level of dedication, and how much they care for you.

Don't realtors just help me find a home?

Realtors value does not lie in helping find a home. The true value is advocacy, strategy, and knowledge of the contract. If your realtor can’t tell you how to protect yourself; they may not know or even worse don’t care.

How long does the process take?

There are three key phases in the home-buying process. The first involves financial preparation, including obtaining pre-approval for a loan. The second phase is the search for the ideal home. Lastly, the period from having your offer accepted to closing usually spans 30 to 45 days.

What's the cost to pay realtor to help me buy?

Typically, you don’t pay anything to a realtor helping you buy. The seller pays for the commission of the buyer and seller agent. Even though the buyer agent gets paid from the seller, they have a fiduciary responsibility to their client.

How do I start the buying process?

The first step is knowing your purchasing power. Contact a lender or get your cash in order. If you need a lender we have a few that we recommend. We always recommend different options to see who can get you the best rate and who your comfortable working with.

What are closing costs? How much should I expect to pay?

Closing costs encompass the fees and expenses required to complete your home purchase, distinct from the property’s price, and often include title insurance and escrow fees. Generally, you might anticipate these costs to be about 1% of the home’s purchase price.