What is a 1031 Exchange?

A 1031 exchange, named after Section 1031 of the U.S. Internal Revenue Code, is a strategy used by real estate investors to defer capital gains taxes that would normally be due upon the sale of a property. Instead of selling a property and paying taxes on the gains, an investor can use a 1031 exchange to roll the proceeds from the sale into the purchase of another “like-kind” property. Here are some key points to consider:

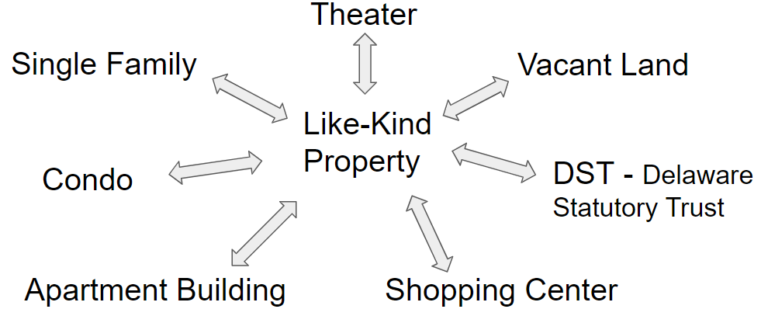

Like-Kind Property

The term “like-kind” refers to the nature or character of the property rather than its grade or quality. Essentially, most real estate properties are considered like-kind to other real estate properties, provided they are held for business or investment purposes.

Use of a Qualified Intermediary (QI)

The IRS requires that the proceeds from the sale of the property be held by a Qualified Intermediary until they can be transferred to the seller of the replacement property. The investor should not take possession of the cash proceeds during the exchange process.

A reputable QI will use segregated accounts separate from their operating accounts and those of other clients. FDIC insurance is another way to help protect the funds.

1031 Exchange Rules

There are two key timing rules in a 1031 exchange. The “Identification Period” gives the investor 45 days from the date of sale of the relinquished property to identify potential replacement properties. The “Exchange Period” allows the investor up to 180 days from the sale of the relinquished property to close on one of the identified properties.

Reinvestment Requirement

To fully defer all capital gains taxes, the investor must reinvest all of the net proceeds from the sale into the replacement property and acquire a property of equal or greater value.

Cash Boot

Cash boot occurs when you receive cash from the exchange either because the replacement property is less expensive than the relinquished property or because not all the proceeds from the sale were used to purchase the replacement property.

Mortgage Boot

Mortgage boot occurs when the mortgage or debt on the replacement property is less than the mortgage or debt on the relinquished property. In this case, you are relieved of a certain amount of debt.

Why Boot matters

Boot is not covered by the tax deferral benefits of the exchange. The IRS may view boot as a form of gain from the exchange and it is taxed as capital gains.

Debt Replacement

If there was debt on the relinquished property, the investor must take on at least the same amount of debt on the replacement property to avoid being taxed on debt relief, which is considered boot.

Variations

There are several types of 1031 exchanges, including simultaneous, reverse, and partial exchanges, each with its own specific set of rules.

**We are not CPA’s | Seek the advice of your CPA