Do you know the performance of your investment properties?

Would you like to know if your rental property is under preforming, over performing, or on par?

Would that be valuable for your investment strategy?

An Asset Performance Test can help you:

Discover the cash-on-cash return for your rental properties.

Determine if your investment is underperforming, overperforming, or on par.

Understand why your investment is underperforming, overperforming, or on par.

Discover what other real estate investment opportunities are out there.

Find solutions for those who don’t want to be landlords anymore.

If you could exchange a lower-performing property with a higher-performing one, would you?

Why most rental properties in Hawaii are under performing...

A large factor to lower rate of return on Hawaii Real Estate is the cost of the land is more expensive due to the limited amount of supply and high demand. Lets look at this example:

Imagine two similar properties: one in Hawaii and one on the mainland. Let’s say each property can generate the same amount of rental income, about $2,000 per month. However, the cost of acquiring these properties is significantly different due to the difference in land values.

– The property in Hawaii can be purchased at $500,000

– The property on the main land can be purchased at $200,000

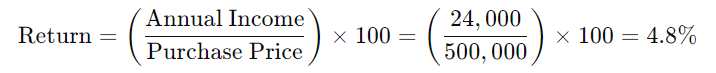

Calculating general gross cash-on-cash return:

For the Hawaii property, the annual income from rent would be $24,000 ($2,000 x 12 months). The cash-on-cash return is calculated as follows:

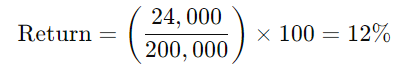

For the mainland property, the annual income is the same $24,000, but the cash-on-cash return would be:

This example clearly shows that despite generating the same rental income, the property in Hawaii offers a lower return of 4.8%, compared to 12% for the mainland property. The main factor here is the higher purchase price driven by the cost of land in Hawaii, reducing the investment’s efficiency in terms of the cash-on-cash return.

What's missing from this example?

Appreciation:

The example above just measured the cash on cash return but did not calculate appreciation into the investment.

Historically, the average appreciation rate for real estate is around 4% per year. However, in Hawaii, the dynamics are slightly different and more favorable due to specific local factors. Because Hawaii has a limited supply of land and consistently high demand, property values tend to appreciate more reliably. This makes appreciation a key aspect of real estate investment in Hawaii.

During economic downturns, like the housing market crash of 2008, real estate markets on the mainland experienced drastic reductions in property values, with some areas seeing declines of 40% to over 50%. In contrast, the real estate market in Hawaii showed remarkable resilience during the same period, with property values only dropping by about 5% to 10%. This stability is attributed to the limited availability of real estate and the enduring demand in Hawaii, making it a more secure investment in terms of maintaining its value through economic fluctuations.

Depreciation:

Depreciation serves as a deductible expense on income generated from the property, thereby reducing the taxable income each year. This can significantly decrease the amount of taxes a property owner pays on rental income. By reducing taxable income, depreciation effectively increases the net cash flow from the property.

Expenses:

Understanding the gross rate of return on an investment is useful, but gaining insight into the net rate of return is even more beneficial. The net rate of return provides a more accurate measure of an investment’s profitability because it accounts for all associated costs and expenses, not just the total income generated.

We need to take into consideration expenses like:

- Repairs & Maintenance

- Property Taxes

- Insurance

- Property Management Fees (If applicable)

- Association Fee (If applicable)

- Vacancies (When property is vacant)

- Capital expenditure reserves (When a fridge, washer, etc. needs to be replaced)

What to look for in an investment property?

Many people keeping their investment property for appreciation. While appreciation is an important aspect, it’s essential not to overlook the opportunity for cash on cash returns. Appreciation is largely influenced by market conditions, which are beyond individual control. Moreover, properties in similar areas tend to appreciate at comparable rates.

On the other hand, we can prioritize properties that yield a higher cash on cash return. This metric reflects the amount of cash flow an investor can expect to receive annually relative to the amount of their initial investment. By focusing on properties with strong cash flow potential, investors can maximize their investment.

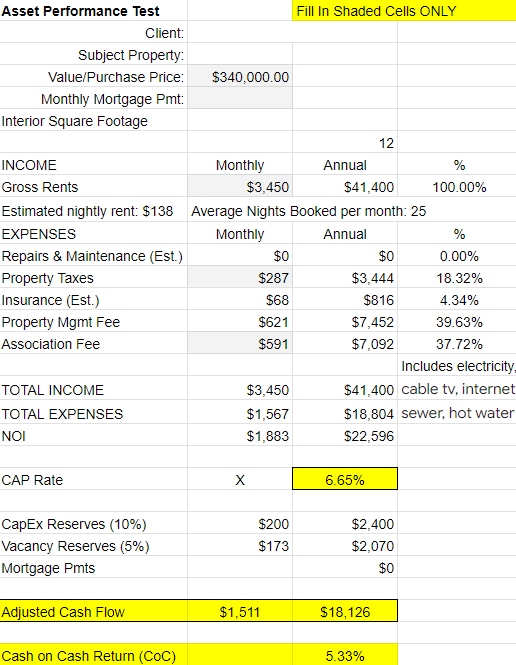

In the Hawaii market, the most lucrative cash on cash returns are often found in the short-term rental market. While there are hundreds of buildings legally zoned for short-term rentals, we selectively recommend only a handful. This approach ensures that our clients invest in properties with the highest potential for profitability and reduced risk.

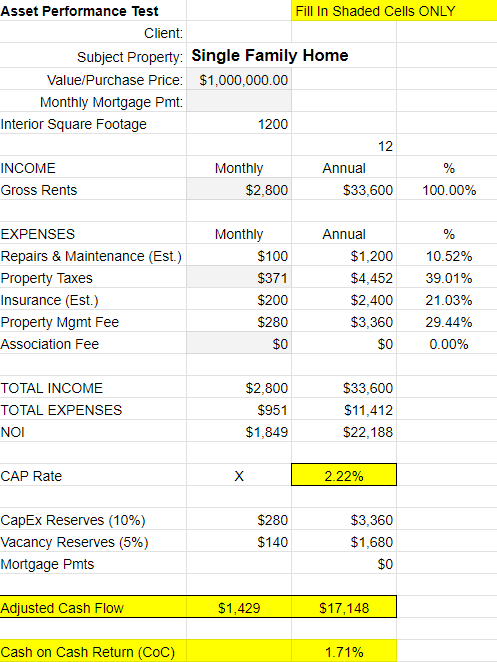

What Most Single Family Homes in Hawaii Look Like

What You Could Get in Oahu