Deciding whether to rent or buy a home is a dilemma faced by many. Each option comes with its own set of advantages and disadvantages. By examining the pros and cons of each, you can better assess which choice aligns with your personal and financial circumstances.

Renting Benefits:

- Lower Up Front Costs: Renting typically only requires a security deposit of one month rent.

- Flexibility: Renting allows you to move without the commitment of selling a home. This may ideal for those who may need to relocate frequently.

- No Maintenance: Generally, landlords are responsible for maintenance and repairs.

Renting Drawbacks:

- No Equity Building: Renting does not allow you to build equity. Typically your rent helps the owner pay their mortgage.

- Limited control and customization: As a renter, you have limited ability to customize or make changes to your living space. You may also be forced to move if the owner decides to sell.

- Rules and Restrictions: Rental properties often come with rules set by the landlord or property management, such as, no pets, restriction on guests, etc.

- Potential for rent increases: When your lease expires, the landlord may increase the rent. This can make future housing costs unpredictable and unaffordable over time.

Benefits of Owning a Home:

- Building Equity: As you make mortgage payments, you increase your ownership stake in the property, which is a form of forced savings.

- Appreciation: Over time property values tend to rise. Historically, real estate appreciates at about 4% per year.

- Tax Exemption when selling: When you sell your primary residence, the U.S. government offers a tax exemption on the profit (capital gains) you make from the sale. If you are single, you can exclude up to $250,000 of this gain from your income for tax purposes, while married couples filing jointly can exclude up to $500,000. This means that any profit you earn up to these amounts is free from capital gains taxes.

- Stability and security: Owning a home provides a sense of stability and permanence. You have the security of knowing where you’ll live long term without the threat of a lease expiration or rent increases.

- Tax Benefits: Homeowners can deduct mortgage interest on their income tax returns, which can reduce the overall cost of ownership.

- Creative Control: As a homeowner, you have the freedom to modify, decorate, renovate your home to fit your needs without needing permission from a landlord.

- Home Equity Line of Credit (HELOC): A HELOC is a type of loan that allows homeowners to borrow money against the equity of their home.

- Potential for Rental Income: Owning a property can open up the opportunity to earn rental income if you choose to rent out part of your home or invest in additional properties.

Drawbacks of Owning a Home:

- Higher Upfront Costs: Their are initial costs of buying a home, such as the down payment and closing costs.

- Maintenance Responsibilities: Homeowners are responsible for the maintenance and repairs of their home.

How Renting will Delay Your Wealth Journey…

Why pay someone else’s mortgage, when you can build your own equity?

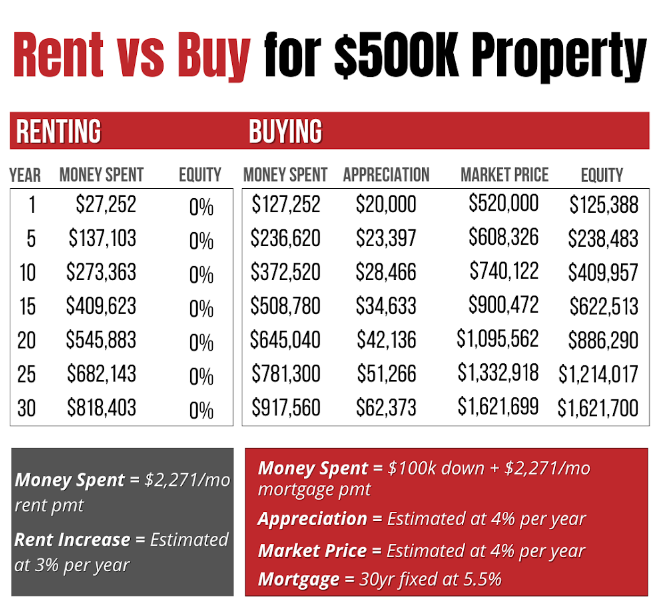

Below is a chart that shows the analytics behind the difference in renting versus buying. The person on the left is renting while the person on the right is buying and they have the same monthly payment of $2,271 per month. The only difference is that the person who bought paid $100K for a down payment. We know that’s a lot of money but let’s see how that investment compounds.

In 30 years, the person renting owns nothing but has spent $818,403 in rent. The person who bought now owns an asset worth $1,621,700. This is why 90% of millionaires have done it through real estate.

There are Pros and Cons to everything. Here is a short skit if renting and buying were people.