Real Estate Planning

Changing the industry from a transactional commodity to relational consultants

- Helping individuals/families build, protect, and transfer wealth.

- Legacy planning – Avoid the all too common family dispute over real estate.

- Strategize to defer or eliminate capital gains taxes.

- Find safe/comfortable living environments for seniors.

- Analyze the performance of your investment properties | Would you exchange a lower-performing asset for a higher-performing one?

- Navigate the trust and probate process.

5 Strategies for Appreciated Real Estate

1. Sell – Pro: Liquid Cash | Con: Tax

2. Hold for Step Up in Cost basis – Pro: No Tax | Con: Tax Planning Inflexibility, Active management, Liquidity Risk, and Estate Planning Challenges

3. 1031 Exchange – Pro: Deferred Tax | Con: Have to reinvest proceeds from sale, Only for Investment Properties

4. Delaware Statutory Trust – Pro: Deferred Tax, No management responsibilities | Con: Concentration Risk, Lack of Control, Lack of liquidity

5. 721 Exchange – Pro: Can Divide, No Management, Cost Basis First | Con: Can’t do 1031 back into real estate, may be challenging with existing debt

Predetermine Your Kids Inheritance and Create a Legacy for Loved Ones.

Did you know that 70% of families fight over real estate? It breaks our hearts to see so many families go through this. We believe in creating a plan to prevent family disputes. However, this plan not only has the potential to avoid family disputes but also to avoid/eliminate capital gains taxes, eliminate properties that are a burden, create a legacy for your loved ones, and experience the joy they receive.

Should I rent or buy?

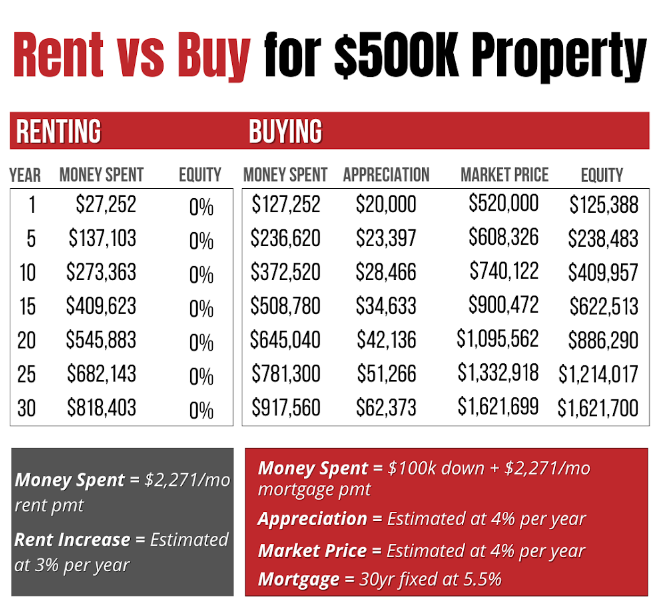

The person on the left is someone who is renting while the person on the right is someone who bought. They pay the same monthly payment except the person who bought put 100K down payment.

After 30 years the person renting has nothing but the person who bought has an asset now worth over 1.6 million dollars. This is the power of compounding and why 90% of all millionaires have done it on the back of real estate.

Asset Performance Test

Do you know the performance of your investment properties? Would you like to know if your rental property is under preforming, over performing, or on par? Would that be valuable for your investment strategy? Would you like to test the performance of your rental property?

-

Discover the cash-on-cash return of your rental properties.

-

Determine if your investment is underperforming, overperforming, or on par.

-

Understand why your investment is underperforming, overperforming, or on par.

-

Discover what other real estate investment opportunities are out there.

-

Solutions for those who don’t want to be landlords anymore.

-

If you could make more money, would you?

Senior Living Options

We believe in safe/comfortable living environments as we age.

Are you curious about where you’ll be living in the future as you get older?

Are you concerned about providing for the care of a loved one?

Are you wondering if you have enough money to pay for your care?

How do you know when it’s time to move?

Is your home too large, now that the kids are gone?

Is your home and or yard too much work to maintain?

Does your home have too many steps?

Are you tired of cooking and cleaning?

Are you living alone and concerned about security?

- Downsizing to a smaller/House/Townhouse/Condo

- Move in with family or Have family move in with you

- Aging in place & bring care in

- Retirement Communities – have all the food, cleaning and assistance needed

- Transition to a Care Home

Renovation Work

We have reliable and trusted vendors who meet our strict quality standards. Not only can we introduce you to these professionals, but we also take on the responsibility of overseeing their work for you. Our initial step involves securing a detailed estimate for the proposed scope of work. Should you decide to proceed, we take care of the rest, allowing you to remain stress-free and focused on what matters most to you.

Client Testimonials