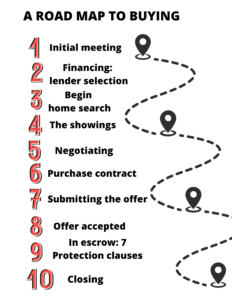

What are the Steps to Buy a Home?

1. Initial Meeting

Meet to Understand Your Needs, Wants, and Future Goals

Understand:

- Location (proximity to schools, work & activities)

- Size | Floor Plan

- Number of Bedrooms and Bathrooms

- Views | Topography

- Condition of Property (Excellent – Tear Down)

- Amount of time & Investment for improvements

2. Lender Selection

- Select a Local, Reputable, and Experienced Lender

- Determine Financing Options

- Determine what you can Qualify for and what’s Comfortable

- Have a Lender pre-approve you

In the current real estate market, being pre-approved is necessary to show the seller you are able and ready to purchase a home. In order to get preapproved, you need to apply with a local lender. If you would like recommendations on trusted lenders, please reach out and we can provide some recommendations.

3. Begin the Home Search

Now is the fun part. After determining your comfortable budget and home buying needs, we will strategically search for properties that fit your criteria.

- Enter parameters into MLS system & jointly identify properties to view

- Coordinate showing schedule to efficiently find your home

4. The Showings

We believe that visiting homes will help you to understand what you like and disklike. We want to understand what your preferences so we can efficiently find your dream home.

At the showing:

- Look past the stuff (image the property cleared out)

At showings there may be owner or tenant-occupied properties. We ask you to imagine the property without any clutter.

- Hold Thoughts if Seller’s Agent is Present

If the seller’s agent is present during a showing, it’s important to keep your opinions to yourself. We view the showing as the beginning of negotiations, and we want to control what information the seller’s agent knows about us. Expressing negative feedback openly can give the impression that you might be challenging to work with. If it comes down to choosing between our offer and another that is identical, the seller’s agent might favor the other party if they believe working with us could be difficult.

- Identify key likes & dislikes

- After each property, review and share thoughts

- Rate each property on a scale of 1-10

- When you rate the property, ask yourself, what would make it a 10? This will help you identify what your looking for.

5. Negotiation

- Starts with the initial showing and ends at closing.

- Proper questions can place you in a position of strength.

- Negotiate price and terms

- Negotiate each contingency

6. How to Make A Winning Offer?

When submitting an offer, it’s beneficial to know if there are other competing offers. Understanding the number and strength of these offers can help you understand the competitive nature of the market

- Offer before other offers (When sellers accept offers as they are received)

- Learn about the Seller – needs/motivation

- Study the market in depth

- Write the offer with attractive terms to the Seller

- Write a personalized cover letter to touch emotions

- Use special provisions to give you the advantage

- Determine how much you are willing to pay for the home (When Competing against other offers)

If it’s a competitive market then our job is to strategically position your offer to stand out over competing buyers. To make a winning offer, our strategy involves understanding the seller’s top priorities. By identifying what’s most important to them, we can tailor your offer to align with those interests. This approach helps position your offer more favorably against the competition, to give you the best shot at winning.

7. Submitting the Offer

Before submitting the offer, we would like to review the offer with you so you know what you’re signing. When submitting the offer we will do a few things.

- Attach a Cover Letter – Touch the emotion of the seller

When selling a house, especially one that’s been in the family for a long time, sellers might consider more than just the highest offer. Emotional attachment to the home can play a significant role. For some sellers, it’s important that the new owner values the home and fits well within the community. If you can connect with the seller on an emotional level—perhaps by expressing your appreciation for the home’s unique character, sharing your vision for living there or having shared values—they might favor your offer.

This emotional connection can sometimes be so influential that a seller might accept your offer over others who are financially higher because they feel more confident about the type of stewardship their beloved home will receive.

- Pre-Approval Letter – Proof of ability to purchase

When submitting an offer for a home, it’s beneficial to include proof of financial ability, like a pre-approval letter, right away. Though typically provided during the escrow process, offering it upfront can increase the seller’s confidence in your offer and enhance its attractiveness. A top-notch lender will proactively reach out to the seller’s agent to affirm the buyer’s financial strength and reliability.

- Provide Comparables – Validate fair market value (if not competing)

If a home has been on the market for some time without much interest, it’s important to justify why we are submitting an offer at a certain price, especially if it’s below the listing price. This helps validate our proposed price to the seller.

8. Congratulations! Offer Accepted

This is when the seller accepts the price and terms of your offer. Once both parties agree in writing we open escrow. Here is what happens next:

- Open Escrow:

This is the formal start of the purchase process. We will help you to send all necessary documents and initial deposit to escrow. Escrow will hold the money and documents until all the conditions of the sale are met. They also manage the distribution of documents and funds according the to purchase agreement.

- Determine Financing:

Ensure that the lender has all the required documents, deposits, etc. to meet financing deadlines

- Coordinate all inspections:

We will help coordinate inspections (Home Inspection, Termite Inspection, etc)

- Conduct due diligence

The escrow process provides a secure period during which the buyer can thoroughly investigate the home they are purchasing. This includes conducting inspections, reviewing property documents, and ensuring that all legal and financial conditions are met before finalizing the purchase.

Typically 45-60 days until you get the keys

9. In Escrow: Protection Clauses

Do you want to protect yourself in the buying process? This is your opportunity to protect yourself.

Throughout escrow, you may have seven cancellation provisions. The contract gives buyers a period to conduct due diligence and if you discover any issues that make you uncomfortable proceeding with the purchase, you have the right to cancel the contract and search for another property.

7 Cancellation Provisions:

- Seller’s Disclosure Statement

When reviewing the seller’s disclosure statement, if you find any issue you find unsatisfactory you have the right to cancel the purchase within the specified time period.

- Home Inspection Period

During this period, we recommend hiring a professional home inspector to evaluate the property. Based on the findings from the inspection, you have three options:

- Cancel the Purchase: If the inspector identifies any critical issues you are uncomfortable with, you can withdraw from the transaction.

- Proceed to Closing: If the inspection confirms that the home meets your expectations, you can move forward with the purchase.

- Request Repairs or Credit: If there are issues, you can ask the sellers to either fix the problems or provide a credit for the repair costs.

Upon receiving your request for repairs or credit, the seller also has three choices:

- Agree to your request for repairs or credit.

- Deny your request.

- Negotiate a compromise, such as offering a smaller credit or fewer repairs.

Based on the seller’s response, you can decide whether to proceed with the purchase or cancel the purchase and find another home.

- CC&Rs | Condo Documents

CC&R stands for Covenants, Conditions, and Restrictions. These are obligations that are recorded against the property. This can cover a wide range of topics like:

- Architectural guidelines: What you can and cannot build or alter on your property

- Use Restrictions: Whether you can operate a business from your home, etc

- Maintenance obligations: Who is responsible for maintaining certain areas like laws, driveways, etc)

- Homeowners association: Associations may have restrictions on what you can and can not do with the home. For example, an association may not allow you to paint your home a certain color or restrict building a deck.

Associations typically oversee condominiums but can also govern single-family homes in certain communities. Both condos and homes in these communities are subject to guidelines that outline what residents can and cannot do. The seller is obligated to provide the buyer documents if they exist and are obtainable. These documents may be:

- Approved Meeting Minutes

- Bylaws

- Current Financial Statements

- Current House Rules

- Insurance Summary

- Reserve Study

- Planned Community Documents

If you find something unsatisfactory, you can cancel the purchase within the specified period.

- Survey & Staking (For Single Family Homes)

A survey marks the corner points and property line. It will also show if there are any improvements (fences, walls, etc) along the property line. You want to know if there are any encroachments.

An encroachment is an improvement on your neighbor’s property by more than .5 feet or your neighbor’s improvement on your property by more than .5 feet. This can lead to disputes between neighbors. We may recommend an encroachment agreement. If you find something in the survey or staking that is not satisfactory you have the right to cancel the purchase within the time period.

- Termite Inspection Report

A termite inspector will assess the property and issue a report with recommendations. If treatment is recommended, such as tenting or spot treatment, the seller is typically responsible for covering the cost of these treatments.

- Preliminary Title Report

If you discover any issues in the preliminary title report that you find unsatisfactory, you have the right to cancel the purchase within the specified time period.

- Financing Contingencies

If the purchase of a home depends on securing a loan, you are not obligated to proceed with the purchase if you are unable to obtain the loan.

10. Closing on the sale

Congratulations on becoming a new homeowner! The keys are now yours. Enjoy your new home!

Our Promise to You

- Review and explain the process, so you can make educated and informed decisions

- Be there every step of the way

- Be your advocate

- Work hard find you the right home

Buyer's Presentation

Is buying a home a big deal? Do you want to know how to protect yourself in the home buying process? Would you like to learn buying best practices?