Embark on a journey through the intricate landscape of real estate investment, where success is built upon five foundational pillars: Appreciation, Cash Flow, Depreciation, Leverage, and Tax Benefits. Utilizing all 5 pillars of real estate will help you to maximize your investments.

1. Appreciation

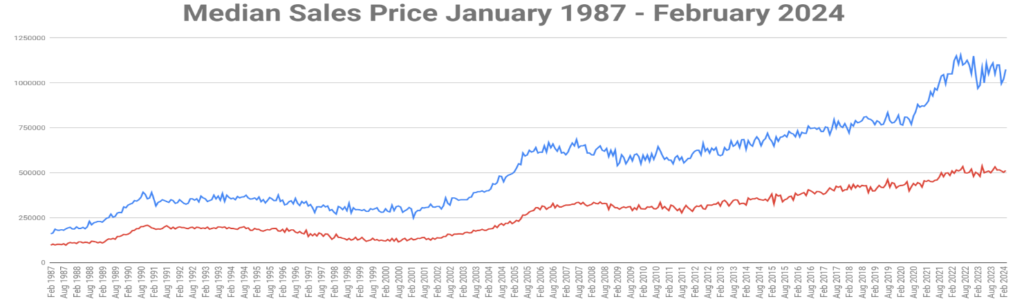

Your property value will increase over time. Historically real estate has appreciated around 4 to 5 percent per year. Hawaii’s appreciation is strong because of the limited supply and robust demand. Real Estate goes in cycles of around 7-12 years. During this cycle the prices rise and then plateau slightly then increase again. Below is the median sales prices of Oahu for the last 37 years.

2. Cash Flow

Receive cash from investment property every month. This is how many people are able to retire early. If you build enough cash flow from your investment properties to cover your active income then you are able to retire.

Not all investment properties are equal. Just like any other investment, you can measure the cash-on-cash return to determine how well your asset is performing. In Hawaii, there are two investment markets: Long Term and Short Term rentals. Typically, short-term rentals yield a higher cash-on-cash return ranging from 5 to 8 percent however, these may have more risk. The long-term rental market is stable with less risk however, typically provides a lower cash-on-cash return of around 3 to 5 percent.

Calculating Cash Flow

Total Income – Total Expenses = Cash Flow

Income: Total income from property being rented.

Total Expenses: Mortgage payments(if applicable), property taxes, maintenance fees, management fees, any utilities not covered by tenants, capital expenditures ex: Fridge breaks and needs to be replaced.

Three Factors Affecting Cash Flow

1. Vacancy Rates: How often is the property vacant and not generating rental income.

2. Rental market: Current trends in the local market, such as average rent prices can affect how much income a property can generate.

3. Operational Costs: Maintenance, upgrades, and management costs can impact overall cash flow.

3. Depreciation

What is Depreciation?

Real estate value is held in the land and building/structure. Real Estate depreciation refers to the decrease in value of the building or structure over time as it deteriorates. Depreciation allows real estate investors to reduce their taxable income by accounting for the cost of wear and tear of a property.

How to Calculate Depreciation in Real Estate?

A common way to calculate depreciation is called straight-line depreciation. Here’s how to calculate depreciation on your investment property.

- Find the value of the building. Don’t include the value of the land as land does not depreciate.

- Find the useful life of the property. The IRS sets residential rental properties to have a useful life of 27.5 years. Commercial properties have a useful life of 39 years.

- Annual Depreciation Expense = Value of building / 27.5

Example: Suppose you bought a house for $800,000. The land value is $600,000 and the building value is $200,000. Annual Depreciation Expense= $200,000/27.5 equalling $7,272.73

This would allow you to deduct $7,272.73 from your taxable income as a depreciation expense for 27.5 years.

Other things to consider is :Depreciation recapture, Resetting Depreciation, and Accelerated depreciation

**We are not CPA’s | Please seek the advice of your CPA

4. Leverage

How does Leverage work in real estate?

Real Estate is an asset that you can utilize leverage to increase your purchasing power. Leverage uses borrowed capital or debt to increase the amount you can buy. Essentially you can buy a $500,000 property and only put down $50,000.

Benefits of Leverage

- Amplify Returns: You will gain amplified returns because appreciation based on total value instead of the amount of cash down. For example, if you buy a $500,000 property will only $50,000 down; you will get appreciation based on $500,000 instead of the $50,000.

- Tax advantages: Interest payments on the borrowed money are often tax-deductible, which can reduce your overall tax burden.

5. Tax Benefits

Primary Residence Tax Exemption

If you sell your primary residence (the home you live in) Section 121 gives you a significant tax exemption. This allows single sellers to exempt up to $250,000 of capital gains from taxes, and married couples filing jointly can exempt up to $500,000. To qualify for this you must have owned and lived in the property for at least two of the last five years.

1031 Exchange

A 1031 exchange, named after Section 1031 of the U.S. Internal Revenue Code, is a strategy used by real estate investors to defer capital gains taxes that would normally be due upon the sale of a property. Instead of selling a property and paying taxes on the gains, an investor can use a 1031 exchange to roll the proceeds from the sale into the purchase of another “like-kind” property.

What is a stepped-up cost basis?

A step-up in cost basis for real estate adjusts the value of an inherited asset for tax purposes from its original purchase price (cost basis) to its fair market value at the time of the owner’s death. This adjustment can reduce capital gains taxes when the inheritor sells the asset.

Benefits of step up in cost basis for real estate

This is the only way to completely eliminate all capital gains taxes. Normally, when you sell an asset, you pay capital gains tax on the difference between the sale price and the cost basis(original purchase price). With a step-up in basis, the cost basis is “stepped up” to the market value at the time of inheritance. The heirs could sell at this time and pay no capital gains taxes.

Inheritance versus Gift

Assets received as an inheritance typically receive a step-up in basis, whereas gifted assets during the donor’s lifetime usually retain the original cost basis. This distinction can significantly impact the tax implications for the recipient.