Carry Over Cost Basis vs Step Up Cost Basis

There are two primary methods for transferring real estate ownership. The first involves transferring the property while your parents are still alive. The second method occurs after your parents have passed away. While these approaches may appear similar, they can lead to vastly different outcomes for your capital gains taxes, potentially altering your financial obligations by tens or even hundreds of thousands of dollars. These two methods will impact how you will determine your cost basis.

What is Cost Basis?

Typically, cost basis is the price at which you bought. However, when your parents transfer their property to you while there still alive, you have a carry over in cost basis. When the property gets transferred upon or after the passing you will receive a step up in costs basis.

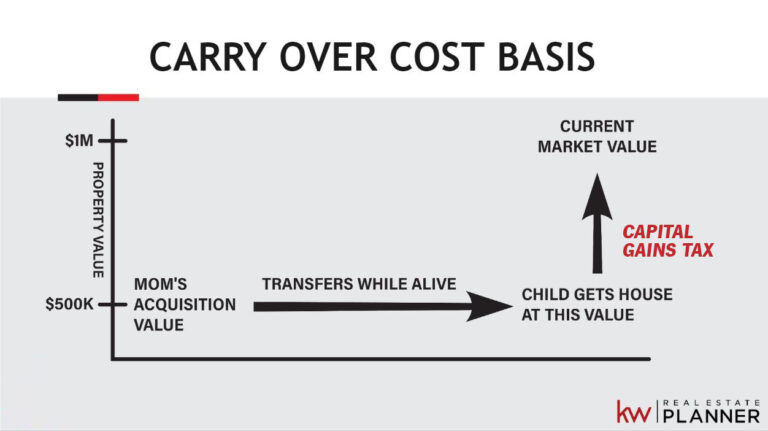

What is Carry Over Cost Basis?

Carry over in cost basis goes back to the original cost basis.

For example: Let’s say your mom bought a home for $100,000 and she transfers the property to you 40 years later (while mom is still alive), you will absorb her costs basis of $100,000. So if the property is now worth $1,000,000 and you want to sell, you will have $900,000 of gain and will be liable to pay tax on that gain. Capital gains tax can be up to 30% and with a $900,000 gain, you are liable to pay $300,000 in capital gains taxes.

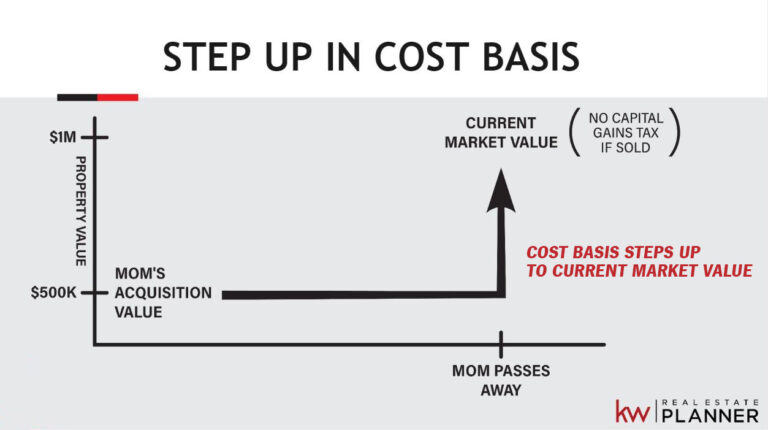

What is Step Up Cost Basis?

A step up in cost basis is a tax provision that adjusts the costs basis of an inherited asset to its market value at the time of the original owners death. This adjustment is significant because it can eliminate or reduce the capital gains tax liability when the inheritor sells the asset.

Example: Let’s say your mom bought a home 40 years ago for $100,000, and the property transfers to you upon her passing. You will receive a step-up in cost basis to the property’s value at the time of her death. So, if the home is worth $1,000,000 when you inherit it and you decide to sell, you could sell the home and pay no capital gains tax. In this scenario, understanding this could save you $300,000.